www.tax.ny.gov basic star exemption

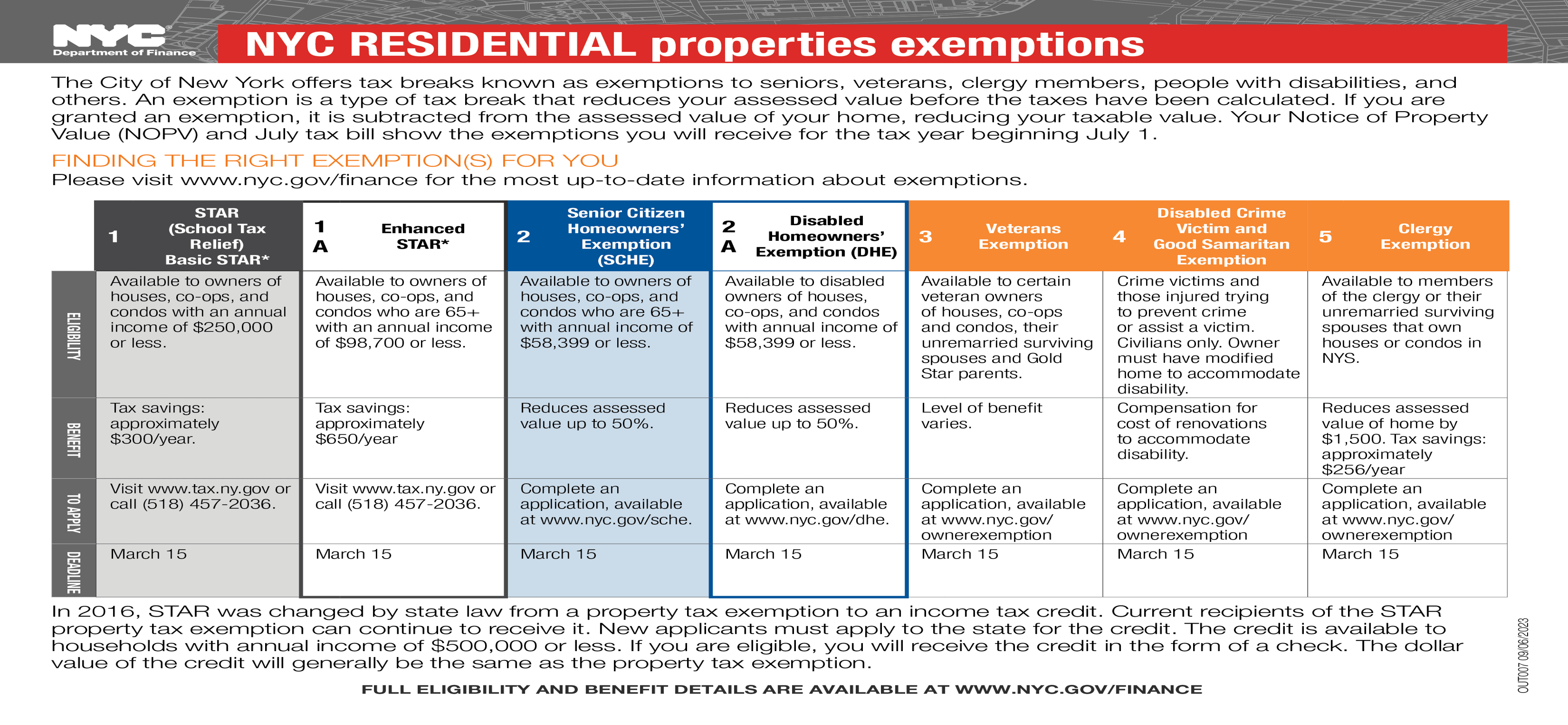

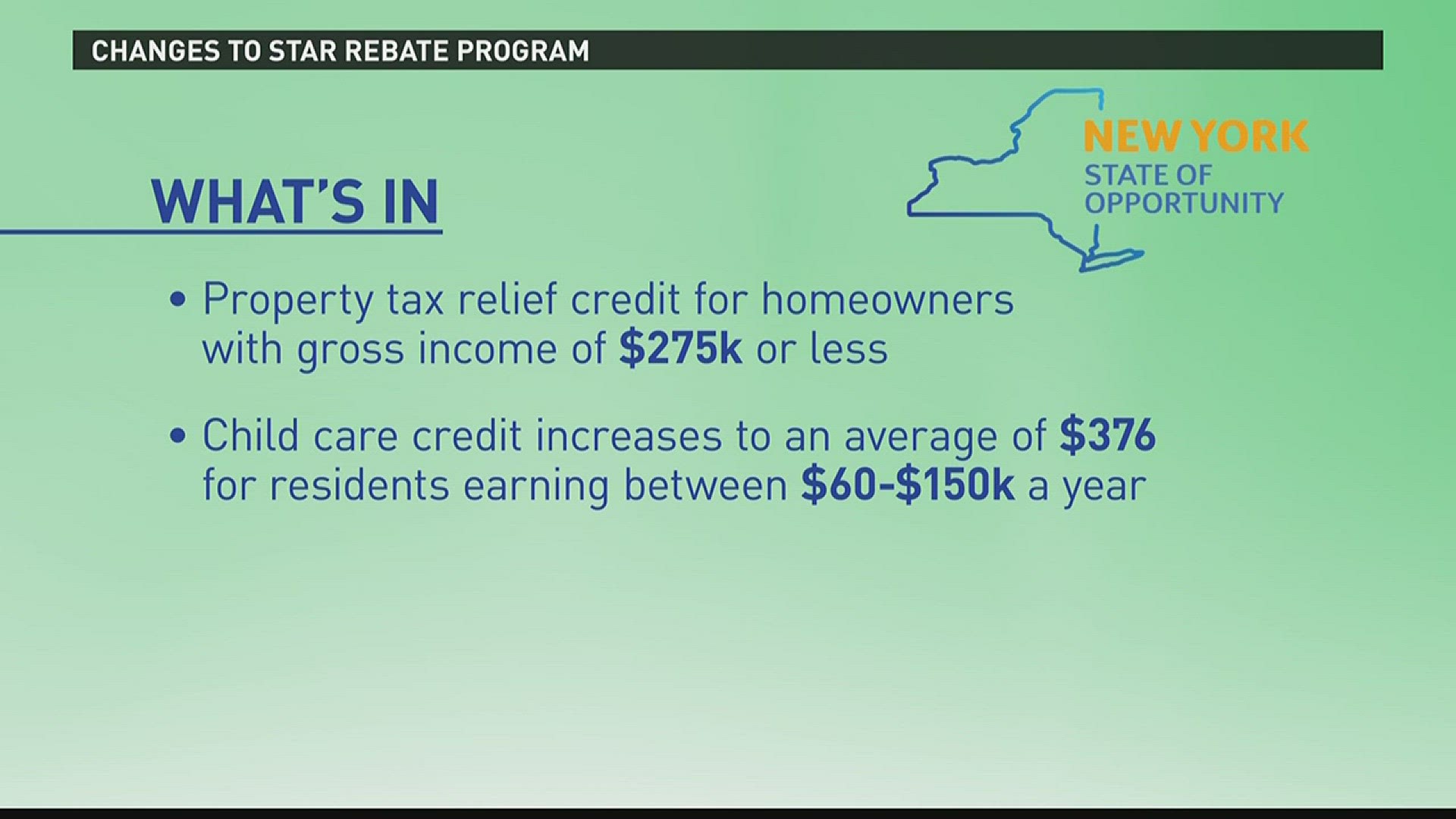

Basic STAR is for homeowners whose total household income is 500000 or less. HOME IMPROVEMENT PROPERTY TAX EXEMPTION STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner-occupied.

Enhanced Star Program Information Town Of Coeymans

Enhanced STAR exemption applicants must apply on or before March 1 2018 to receive STAR benefits in the fall of 2018.

. PDF File -- 1 page 85 x 14 Legal Size Paper RP-460 Application for Partial Tax. Use Form RP-425. The deadline to file for all exemptions is March 1.

Affidavit for Exemption of Real Property By Minister Priest Rabbi or Widow. 2023-2024 Enhanced STAR Property Tax Exemption Application FOR USE BY HOMEOWNERS WHO WERE ENROLLED IN THE STAR PROGRAM PRIOR TO JANUARY 2 2015 Nassau County. To apply to STAR a new applicant must.

You currently receive Basic STAR and would like to apply for Enhanced STAR. You may be eligible for Enhanced STAR if. You only need to register once and the Tax.

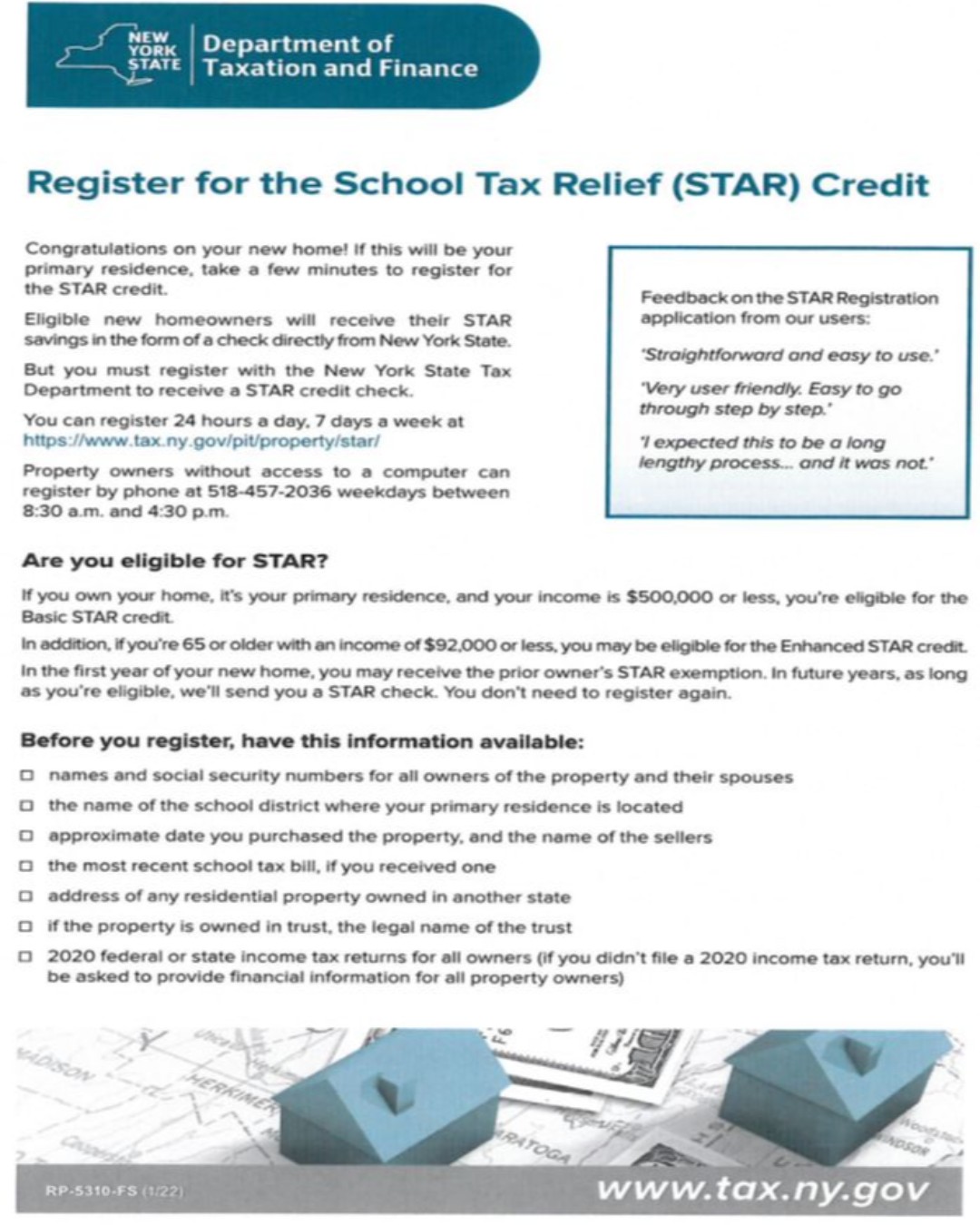

Register for the Basic and Enhanced STAR credits. STAR helps lower property taxes for eligible homeowners who live in New York State school districts. Enhanced STAR credit applicants should register as.

All applications are due by March 1 2023 for the 202324 December 2023 - November 2024 Tax Year. To be eligible for Basic STAR your income must be 250000 or less. Resident homeowners applying for STAR for the first time are not affected by this years registration procedure.

The process to apply for a STAREnhanced STAR EXEMPTION has opened. Available if you own and occupy a residential property with federally adjusted gross income. The basic STAR exemption is available for owner occupied primary residences regardless of age but a household income less than 500000 on the previous years tax return.

Star School Tax Relief Basic Exemption. The STAR program can save homeowners hundreds of dollars each year. Exemption Forms for Clergy.

The Basic STAR application is for owners who were in receipt of the STAR exemption on their property as of the 2015-16 tax year but later lost the benefit and wish to restore it. It will exempt the.

Do You Receive A Star School Property Tax Break Have You Re Registered To Keep Receiving Your Basic Star Exemption Read More Ny State Senate

Rebate Checks Are Coming What To Know This Year Wgrz Com

Tax Collector Tax Assessor Town Of Lewis Ny

Budget Fact Sheets Marcellus School District

2018 Question And Answers About Enhanced Star Ny State Senate

Application For School Tax Relief Star Exemption

Fillable Online Tax Ny Star Property Tax Exemption Form Fax Email Print Pdffiller

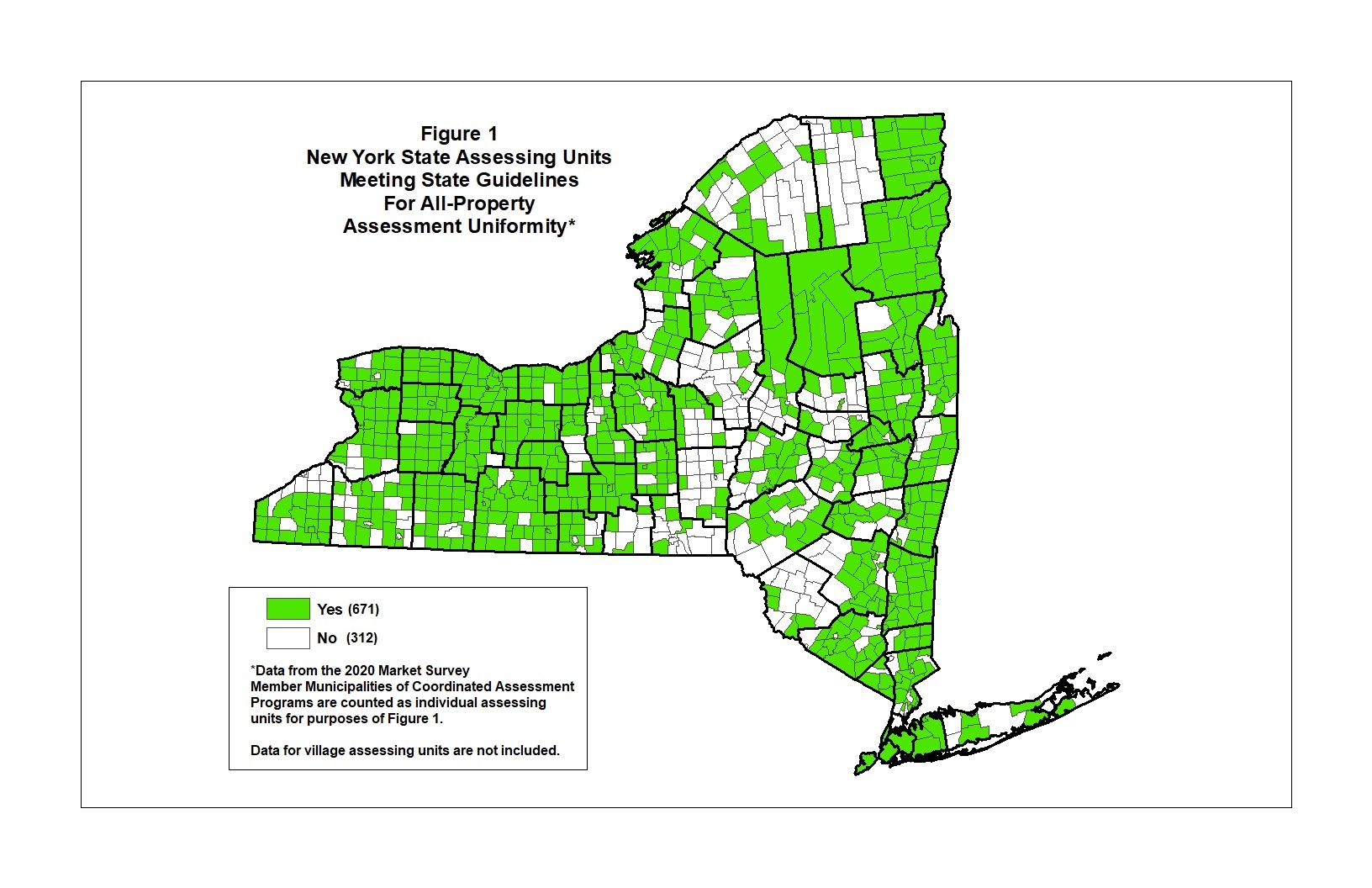

04 19 2021 Assessment Community Weekly

Register For The School Tax Relief Star Credit By July 1st Greene Government

Tax Dept Says Most In Ny Have Registered For Basic Star Exemption

Register For Star Town Of Huntington Long Island New York

Deadline Coming Up For Seniors To Apply For Enhanced Star Exemption Wham

Town Of Salina On Twitter Register For Basic Star Credit If Property Is Your Primary Residence Amp Income Is 500 000 Or Less Https T Co Svry6rjmdn Or By Phone Weekdays 8 30am 4 30pm 518 457 2036

Application Deadline Nears For Enhanced Star Property Tax Exemption Westside News Inc

Assessment Victor Ny Official Website

Did You Get Your Tax Rebate Check Yet Here S How Many Haven T Gone Out